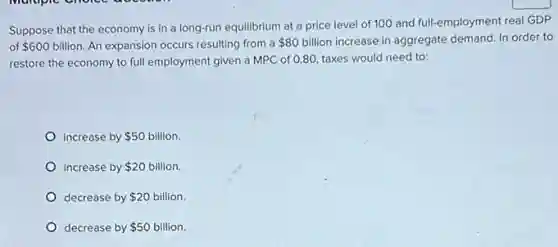

Suppose that the economy is in a long-run equilibrium at a price level of 100 and full-employment real GDP of 600 billion. An expansion occurs resulting from a 80 billion increase in aggregate demand. In order to restore the economy to full employment given a MPC of 0.80, taxes would need to: increase by 50 billion. increase by 20 billion. decrease by 20 billion. decrease by 50 billion.

Solution4.2(284 votes)

Answer

Explanation

Similar Questions

Which of following is not one of the levels of support for the Marketing Team? International Planning and Development Corporate Planning and Development Regional Planning

Fill in the Blank Question A transaction or event in which the outcome is uncertain is referred to as a(n) $\square $ (Enter one word per blank)

The Meaningful Use program resulted in widespread implementation and adoption of EHRs in __ and ambulatory practices. ACO's Pharmacies Hospitals Outpatient Facilities None of these

Fill in the Blank Question When a manager accepts a project because the net operating income from the investment exceeds the minimum acceptable profit based on required rate of return, the investment was evaluated based on $\square $ $\square $ (Enter only one word per blank)

__ are good limited liability company (LLC) candidates. Small businesses Hotels Casinos Resorts

What should company officers do if they believe there is a change in the balance of risk to benefit during an incident? Select one: A. Continue with their assignments B. Change their tactics accordingly C. Withdraw without delay D. Report their observations to the incident commander

The "direct effect" of an increase in the money supply is to A increase aggregate demand as people spend their excess money balances. B increase aggregate demand as interest rates fall and investment spending increases. C increase aggregate supply as producers anticipate higher future profits. D decrease the rate of inflation.

Which of the following has led to gains for top earners since 2001? Multiple Choice changes in tax policy changes in the nation's job market the "compression effect"described by economist Paul Krugman a booming goods and services sector All these answers are correct.

When brainstorming with your team, what is the first step in your process? Defining the steps in your process Creating a process map Changing the manufacturing process Talking to customers

Question 5 (2.5 points) The advantages of using electronic data interchange (EDI) are all of the following EXCEPT to avoid all errors in submission of claims. to receive response and reimbursement for claims in a short amount of time. to submit clean claims and know they will all be accepted by the health plan. to save time and energy since mailing paper claims costs money.