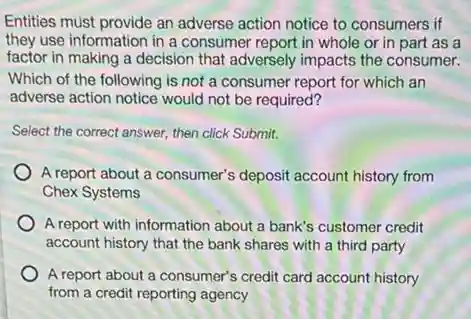

Entities must provide an adverse action notice to consumers if they use information in a consumer report in whole or in part as a factor in making a decision that adversely impacts the consumer. Which of the following is not a consumer report for which an adverse action notice would not be required? Select the correct answer.then click Submit. A report about a consumer's deposit account history from Chex Systems ) A report with information about a bank's customer credit account history that the bank shares with a third party A report about a consumer's credit card account history from a credit reporting agency

Solution4.7(281 votes)

Answer

Explanation

Similar Questions

An economic system dominated by the supply-demand-price mechanism called the "market"is capitalism. communism ) market exchange. redistribution.

New Government Employment and True Unemployment. Suppose the U.S. government hires workers who are currently unemployed but does not give them any work to do. What will happen to the measured U.S. unemployment rate? The unemployment rate will decrease Under these circumstances, do changes in the measured U.S. unemployment rate accurately reflect changes in the underlying economic situation and production? A. No. GDP will increase though the underlying economic situation will not have improved. B. Yes. GDP will increase and the underlying economic situation will have improved. C. No. GDP will remain unchanged and the underlying economic situation will not have improved. D. Yes. GDP will remain unchanged though the underlying economic situation will have improved.

Fill in the Blank Question One factor that affects the price of a life insurance policy is the rate of death among policyholders also called $\square $ rate.

The human-capital theory explanation for why people invest in education has been challenged by a theory that suggests a. humans cannot be considered "capital." b. productivity is not linked to wages. c. schooling acts only as a signal of ability. d. ability, effort, and chance matter more.

What happens to the labor supply curves in both countries when Mexican workers leave Mexico and move to the United States? a. Labor supply increases in the United States and increases in Mexico. b. Labor supply increases in Mexico and decreases in United States. c. Labor supply increases in the United States and decreases in Mexico. d. Labor supply decreases in Mexico and decreases in the United States.

True or false: All classes of stock issued by a firm must have equal voting rights. True False

Economists study poverty and income inequality to answer which of the following questions? a. How do people adjust their behavior due to taxation? b. What are people's wages? c. How does labor-force experience affect wages? d. How much inequality is there in society?

True or false:Common stock has a set maturity. True False

How many years will it take for an initial investment of $\$ 20,000$ to grow to $\$ 30,000$ Assume a rate of interest of $10\% $ compounded continuously. It will take about $\square $ years for the investment to grow to $\$ 30,000$ (Round to two decimal places as needed.)

What interest rate compounded semiannually will yield an effective interest rate of $4\% $ 7 A rate of $\square \% $ compounded semiannually will yield an effective rate of $4\% $ (Round to two decimal places as needed.)