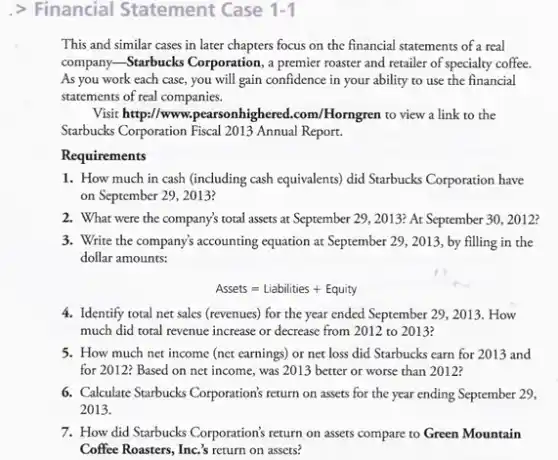

> Financial Statement Case 1-1 This and similar cases in later chapters focus on the financial statements of a real company-Starbucks Corporation, a ampon premier roaster and retailer of specialty coffee. As you work each case, you will gain confidence in your ability to use the financial statements of real companies. Visit http:/www.pearsonhighered .com/Horngren to view a link to the Starbucks Corporation Fiscal 2013 Annual Report. Requirements 1. How much in cash (including cash equivalents)did Starbucks Corporation have on September 29, 2013? 2. What were the company's total assets at September 29, 2013? At September 30, 2012? 3. Write the company's accounting equation at September 29., 2013, by filling in the dollar amounts: Assets=Liabilities+Equity 4. Identify total net sales (revenues) for the year ended September 29, 2013 . How much did total revenue increase or decrease from 2012 to 2013? 5. How much net income (net earnings) or net loss did Starbucks earn for 2013 and for 2012? Based on net income, was 2013 better or worse than 2012? 6. Calculare Starbucks Corporation's return on assets for the year ending September 29, 2013. 7. How did Starbucks Corporation's return on assets compare to Green Mountain Coffee Roasters, Inc's return on assets?

Solution4.6(274 votes)

Answer

Explanation

Similar Questions

Which of the following is NOT a step in the ULD loading process? Ensuring the ULD is serviceable Securing the cargo within the ULD Having the cargo inspected by K9 Loading lighter pieces on top of heavier pieces

5. For whom is joint ownership of an annuity often reserved? a. spouses b. an individual and any family member c. two or more business partners d. trusts

What cost area is associated with paying for needed repairs and upgrades to a nonprofit's operational facility damaged during a hurricane? Programs Growth capital Reserves Debt

Why are circular flow models useful for economists? A. They predict whether an economic proposal will be successful. B. They explain the causes of economic problems throughout history. C. They analyze the rise and fall of investments value over time. D. They track the flow of money through different parts of an economy.

Wages tend to be sticky in part A because of contracts B because of taxes C because of government purchases D because of budget deficits

Suppose a stock market boom makes people feel wealthier. The increase in wealth would cause people to desire A increased consumption, which shifts the aggregate-demand curve right. B increased consumption, which shifts the aggregate-demand curve left. C decreased consumption, which shifts the aggregate-demand curve right. D decreased consumption, which shifts the aggregate-demand curve left.

n which principle of value is the sales comparison approach based? Anticipation Competition Conformity Substitution

The Federal Reserve's two main monetary policy targets are A. price stability and high employment. B. price stability and the money supply. C. interest rates and high employment. D. the money supply and interest rates.

Managers should always be alert to trends that affect revenues or expenses. A True B False

The eight-second rules refers to a time restriction for __ receiving a payment confirmation website downloads the length of an advertising video sales transaction processing