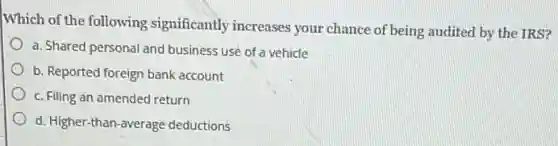

Which of the following significantly increases your chance of being audited by the IRS? a. Shared personal and business use of a vehicle b. Reported foreign bank account c. Filing an amended return d. Higher-than-average deductions

Solution4.2(332 votes)

Answer

Explanation

Similar Questions

How would a contract negotiation committee use information provided by the CDM? to develop policies and procedures for auditing posted charges to prevent re-auditing after corrective actions to capture the role of key performance metrics to understand how clinical services impact reimbursement structure

A firm charges different groups of customers different prices in order to increase revenue and cost Senior citizen discounts are an example of this type of pricing. decrease cost and increase profit. Student discounts are an example of this type of pricing. increase revenue but not profit. Higher holiday airfares are an example of this type of pricing. increase revenue and profit Lower afternoon movie prices are an example of this type of pricing.

Which of the following is a key component of best practice protocols that help assure appropriate and consistent charges? charge reconciliation remediation to prevent issues extensive documentation flow charts that indicate the charge request process

Question 27 (Mandatory) (1 point) Katherine was laid off from her job 11 months ago. After searching for a job for months, Katherine gives up her job search because she feels there are no jobs available for her Economists would classify Katherine as unemployed. in the labor force. underemployed. employed. a discouraged worker.

Which of the following is a method that governments use to improve urban transportation? Designate lanes as carpool-only. Give tax rebates to people who use only public transportation. Make some public buildings and some communities accessible only by public transportation. Provide motorcycle lanes in the center of rail lines.

A car is not an investment because: You can buy a used one It depreciates in value It might not have a warranty It's not a house

5. When must hazard communication training be conducted for employees? A. At initial assignment. B. Whenever a new chemical is used. OC. When there is a change in the process. D. All of the above.

7) If bad pavement is encountered a driver should: a) Slow speed, stay in the same lane as much as possible and drive with special attention until reaching an area of good pavement b) Slow speed and change lanes as soon as possible c) Continue as normal and drive over the bad pavement as safely as possible so as not to interrupt the vehicles in parallel lanes d) Increase speed to swerve around the bad pavement areas

b. Suppose the supply of loanable funds is stable, but the demand fluctuates from year to year. Which of the following may cause the demand for loanable funds to increase? Choose all answers that apply. A positive outlook on a firm's expectations about the future. An increase in the money supply. A decrease in the interest rate.

What is the minimum frequency for working the Contact Manager queue? once per day twice per day three times per day depends on staffing