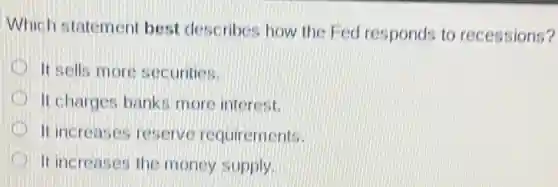

Which statement best describes how the Fed responds to recessions? It sells more securities. It charges banks more interest. It increases reserve requirements. It increases the money supply.

Solution4.1(299 votes)

Answer

Explanation

Similar Questions

Select all that apply. The triangles are congruent by SAS. The triangles are congruent by SSS. There is not enough information to determine whether the triangles are congruent by SSS or SAS. $\angle QMP\cong \angle PMN$ $\overline {NP}\simeq \overline {\cap M}$

A cyclist is competing in a 100-mile race. The cyclist travels at a speed of 17.5 miles per hour.Write an equation in point-slope form to show the relationship between x, the number of hours since the race started, and y, the cyclist's distance from the finish line. The equation in slope-intercept form is $y=-17.5x+100$ $m=-17.5\quad \nabla $ $\square $ . $\square $ Correct! Use 2 as $x_{1}$ Substitute it into the equation to find $y_{1}$

A line is graphed on the coordinate grid. What are the slope and the equation of this line?

The graph of $y=3x-5$ in the xy-plane is a line . What is the slope of the line? A. $-5$ B. $\frac {1}{3}$ C. 3 D. 5 a A b B C C d D

D Proot: Because Bis the m midpoint of $\overline {AC}$ and $\square $ is the midpoint of $\overline {BD}$ we know by the $\square $ that $\overline {AB}\cong \overline {BC}$ and $\overline {BC}\cong \overline {CD}$ Because congruent segments have $\square $ v that Select Choice v/measures. $AB=BC$ and $\square $ Thus, by the $\square $ $AB=CD$ different

10/31 - Triangle Congruence Practice List the 2 properties that will NOT prove Triangles are coneruent $\square $ $\square $

$45^{\circ }$ x $6\sqrt {2}$ $45^{\circ }$

(1) Decide whether each statement is True or False about the expression $m+7$ (1) True 4) False 4) The letter m is a term. 4) The letter m is a variable.

Questions Marcus has his car insurance payment directly withdrawn from his savings account.One month after starting the payment, he had $\$ 915$ in savings. Nine months after starting the payment, he had $\$ 235$ Assume Marcus made no other deposits or withdrawals from the account. Part Alf the relationship between months and the amount of money in Marcus's account is linear.what is the slope? Be sure to include units. $\square $ $\square $ 1 $\square $ Part B: Based on that slope; how much money does Marcus spend each month? $\$ \square $

Solve the inequality $-4y-3\lt 5$ 4) How can you isolate the term $-4y$ 4) Add 3 on both sides. 4) How can you isolate y? $\square $ ? $\square $ on both sides. Add Subtract Multiply by $-4y-3\lt 5$ $+3+3$ $-4y\lt 8$