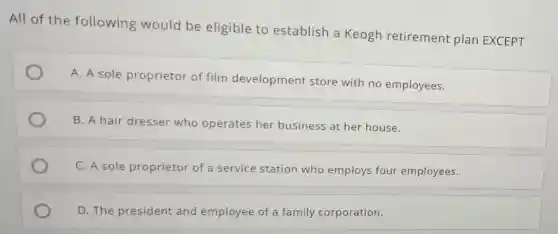

All of the following would be eligible to establish a Keogh retirement plan EXCEPT A. A sole proprietor of film development store with no employees. B. A hair dresser who operates her business at her house. C. A sole proprietor of a service station who employs four employees. D. The president and employee of a family corporation.

Solution4.3(315 votes)

Answer

Explanation

Similar Questions

Question 3 (Mandatory) (1 point) All credit cards have annual fees. True False

Which of the following factors does NOT influence financial planning? Savings Potential future earnings Debt Investments

For a company like Southwest Airlines, which of the following is a weakness? Placing a smiling logo in the company website The lack of support from customers for a potential merger between Frontier and JetBlue Increasing prices for rental cars Increasing competition from other discounted airlines The increasing number of pilots quiting due to fatigue

Multiple Select Question Select all that apply When considering eliminating a product, opportunity costs should __ be considered if alternatives uses exist never be considered only be considered in the company is operating at full capacity C Need help? Review these concept resources. (1) Read About the Concept

Organizing Your E-mail Question 5 of 6 Question: As a project manager, your e-mail traffic is mostly taken up with messages to and from team members, clients and two vendors that are contributing to the project. Much of your focus is devoted to evaluating progress and ensuring that everyone adheres to the schedule. Which e-mail filters would be effective for you? Instruction: Choose all options that best answer the question. D Use the project title as a filter term to route all project-related e-mails Use "update" as a filter term D Use the client's name as a filter to route e-mail to a "Client update" folder D Use team members' e-mail addresses as filter terms to route their e-mails to a folder for team updates Use the names of the two vendors as filter terms to route e-mails to separate folders for each

Question 7 What is an entrepreneurial ecosystem? It refers to the biological behavior of entrepreneurs It refers to the economic orientation of entrepreneurs It refers to the "habitat" of which entrepreneurs are a part. It refers to the ecological orientation of entrepreneurs Question 8 One'tool that could be readily applied to assessing the needs of social entrepreneurs (as well)is the Entrepreneurial-needs Diagnostic Matrix. Which variables are on the horizontal axis and the vertical axis, respectively? Obstacles and Personal competencies Obstacles and Required resource Opportunities and Personal competencies Opportunities and Required resource 2 pts 2 pts

The achievement of full employment through time will: diminish labor productivity. reduce the level of investment as a percentage of GDP. increase the realized rate of economic growth. have no impact on the rate of economic growth.

Other things equal, which of the following would increase the rate of economic growth, as measured by changes in real GDP? A decline in the average length of the work week. A decrease in the labor force participation rate. An increase in the size of the working age population. A decline in the amount of capital per worker.

Other things equal, if a full-employment economy reallocated a substantial quantity of its resources to capital goods, we would expect: present consumption to rise. future consumption to fall. a lower rate of growth of real GDP. labor productivity to rise.

Economic growth can be portrayed as: an outward shift of the production possibilities curve. an inward shift of the production possibilities curve. a movement from a point on to a point inside a production possibilities curve. a movement from one point to another point on a fixed production possibilities curve.