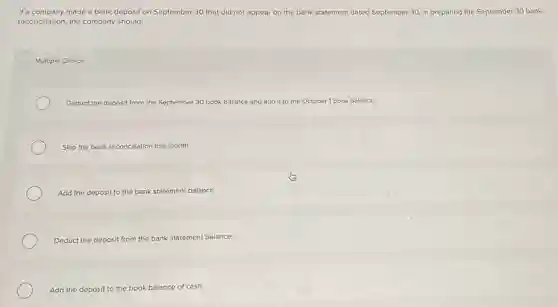

If a company made a bank deposit on September 30 that did not appear on the bank statement dated September 30, in preparing the September 30 bank reconciliation, the company should: Multiple Choice Deduct the deposit from the September 30 book balance and add it to the October 1 book balance. Skip the bank reconciliation this month. Add the deposit to the bank statement balance. Deduct the deposit from the bank statement balance. Add the deposit to the book balance of cash.

Solution4.7(234 votes)

Answer

Explanation

Similar Questions

You start working on a jobsite where they strive for zero incidents or injuries as the ultimate goal and they care deeply that everyone goes home safe. How would you rank their safety culture? Exceptional Basic Compliant Poor

Although competitors understandably are reluctant to share their secrets, information trading for __ is not uncommon and can prove highly valuable. vertical integration technological followership corporate espionage benchmarking gradual diffusion

45. What is an example of a risk to the auditee that could be created by performing an audit? The identification of nonconformities Contamination of an area Questioning employees Observing activities

In the accounting cycle, the last step is a. journalizing and posting the adjusting entries b. journalizing and posting the closing entries c. preparing the financial statements d. preparing a post-closing trial balance

Which of the following should cause the price of a share of stock to rise? a. A reduction in market risk b. An increase in expected dividends c. A reduction in the interest rate d. All of the answer choices should cause the price to rise. e. None of the answer choices should cause the price to rise.

Find the present value of the following future amount. $\$ 400,000$ at $12\% $ compounded annually for 25 years What is the present value? $\$ \square $ (Round to the appropriate cent.)

Most electricians and other construction site workers carry their own listed portable __ cord sets ground-fault circuit -interrupter arc-fault circuit -interrupter

What is the primary goal of sustainable innovation, as described in the Sustainable Innovation? Outsourcing sustainability consulting to external experts Creating new products using only recycled materials Maximizing short-term profits through cost-cutting Designing solutions that benefit both society and the environment

Promotional strategy includes personal selling public relations, and direct marketing. True False

The theory of comparative advantage says you should specialize in producing what you can produce at: the greatest opportunity cost. the greatest absolute cost. the lowest opportunity cost. the lowest absolute cost.