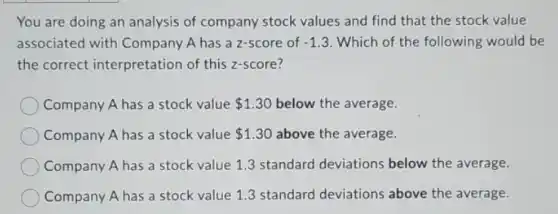

You are doing an analysis of company stock values and find that the stock value associated with Company A has a z-score of -1.3 Which of the following would be the correct interpretation of this z-score? Company A has a stock value 1.30 below the average. Company A has a stock value 1.30 above the average. Company A has a stock value 1.3 standard deviations below the average. Company A has a stock value 1.3 standard deviations above the average.

Solution4.7(115 votes)

Answer

Explanation

Similar Questions

Which of the following statements are true about an effective multiple- rescuer response?Select three answers. Team members should wait for the team leader to assign roles and give direction on what actions to take. Each team member should arrive on scene and be able to perform any role necessary. Critical thinking and communication are essential. Team members should anticipate the next actions other rescuers will take. Team members should continue in their current roles if they do not want to move when the compressor

A Type 1 Excludes note is a pure Excludes note. True ) False

Chris operates the Beans's Brew chain of coffee stands. "Bean's Brew" is . a lingo. a trade secret. a service mark. a trade name.

What's the difference between a franchise and a national firm? Membership in the National Association of REALTORS@ The ownership The size of firm The training

Multiple Choice Question When a performance obligation is satisfied over time revenue is recognized in proportion to the amount of the time spent thus far on satisfying the performance obligation. performance obligation that remains to be satisfied. performance obligation that has been satisfied.

Who is responsible for providing technical expertise about work performed by the employee group? The ASAP Manager The FAA Representative The Employee Representative The Management Representative

Advertising aimed at increasing the demand for all brands of a product within a specific industry is called __ institutional advertising comparative advertising selective-demand advertising primary-demand advertising

Recently, a certain bank offered a 10-year CD that earns $2.9\% $ compounded continuously. Use the given information to answer the questions. (a) If $\$ 20,000$ is invested in this CD, how much will it be worth in 10 years? approximately $\$ \square $ (Round to the nearest cent.)

1. What two things should the office claims processor have before processing a patient's claim? __

Productivity may best be defined as the quantity of production the ratio of outputs to inputs the quality of what is produced the amount of revenue earned Clear my selection