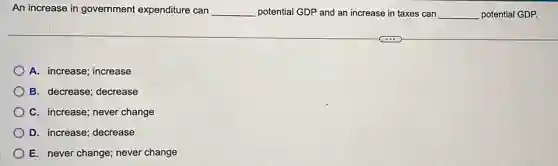

An increase in government expenditure can __ potential GDP and an increase in taxes can __ potential GDP. A. increase; increase B. decrease; decrease C. increase; never change D. increase; decrease E. never change; never change

Solution4.5(318 votes)

Answer

Explanation

Similar Questions

According to classical economists, why do government expenditures NOT induce economic growth? the labor theory of value supply and demand crowding out effect institutional theory

Question 5 of 7 A business with inadequate inventory is at risk of: Select ALL that apply Not being able to fulfill customer orders Lost revenue opportunities Losing business to competitors Damaging customer relationships

Question 24 of 25 Kathey wants to rent a car for 4 days, and she's interested in the collision damage waiver but not the loss damage waiver If the daily rate is $\$ 39$ and the CDW is $\$ 40$ what is her total rental cost? A. $\$ 238$ B. $\$ 228$ C. $\$ 196$ D. $\$ 49$

Fill in the blank fields in this text: $\square $ and $\square $ duties are always to be completed to ensure you and the next shift are set up for success!

If a home costs $\$ 500,000$ what is the down payment probably going to be? $\$ 25,000$ $\$ 50,000$ $\$ 200,000$ $\$ 100,000$

When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at a. a discount b. a premium c. their face value d. their maturity value

Fill in the Blank Question Profits earned by a company that have not been paid to stockholders are called $\square $ earnings. C Need help? Review these concept resources. Read About the Concept

True or False? The Standardized Emergency Management System specifies processes and procedures to follow for all responders and agencies. False True

Which of the following are NOT health care functions at Walgreens? Select all that apply. Photo Pharmacy Beauty Specialty Pharmacy Mail-order Pharmacy

What is a reason for sellers in a monopoly market to have a great deal of power over price? There are no barriers to entry or exit. Their products have many close substitutes. There are only a handful of sellers in the market. Asymmetric information exists in the market.