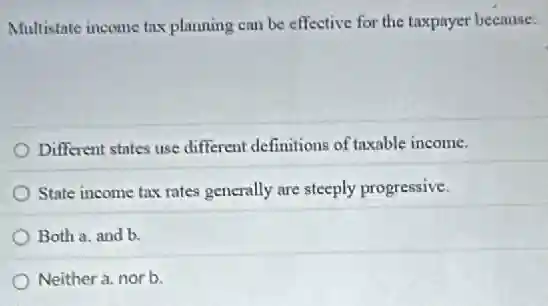

Multistate income tax planning can be effective for the taxpayer because: Different states use different definitions of taxable income. State income tax rates generally are steeply progressive. Both a. and b. Neither a. nor b.

Solution4.7(218 votes)

Answer

Explanation

Similar Questions

A manager who is a consultative leader will ask for a groupâ s views on an issue, but will not always follow the groupâ s advice. True False

We have said that firms prefer to operate in a market where they have few or no competitors. This is because: Competition discourages innovation. Competition decreases the control that a firm has over the price it charges. Competition decreases the likelihood that consumers will find goods that fits their needs. Competition discourages firms from lowering prices. Question 19 Shareholders of a corporation can be __ individuals pension and mutual funds another corporation all of the above are possible 3 pts

Alex Patterson, vice president of brand, discusses that many people in the Tough Mudder organization "wear multiple hats "meaning that employees may perform several roles. As a result, Tough Mudder is a flat organization Which of the following must be true about Tough Mudder? New problems arise frequently at Tough Mudder A great deal of interaction is required between supervisor and workers Tough Mudder has a well-established set of standard operating procedures Workers are physically located far from one another

Which statement best describes how an investor makes money of debt? An investor makes money by issuing bonds. An investor makes money by earning interest. An investor makes money by raising capital. An investor makes money by being repaid for the principal.

Multiple Choice 0.25 points Using a perpetual inventory system, the entry to journalize the return of merchandise purchased on account includes a credit to Accounts Payable credit to Sales credit to Inventory debit to Cost of Goods Sold

All of the following are stockholders' equity accounts except Investment in Stock. Common Stock. Dividends. Retained Earnings.

When marginal cost is equal to marginal revenue , this is the best level of output. True False

When the selling price of a good goes up, what is the relationship to the quantity supplied? The cost of production goes down. The profit made on each item goes down. It becomes practical to produce more goods. There is no relationship between the two.

A corporation formed in another country and doing business in the United States is a domestic corporation foreign corporation alien corporation S-corporation void ab initio corporation

Bryan wants to target the market for his pool cleaning service. He has thoroughly studied his customers. What other information does Bryan need? information about other pool cleaning services information about public pools in the area information about economical media outlets information about saltwater versus chlorine pools