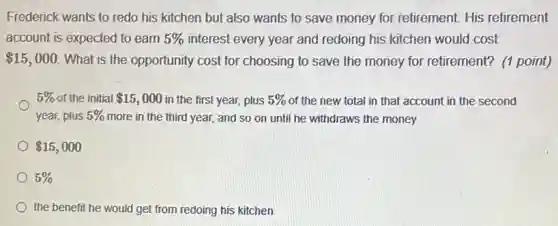

Frederick wants to redo his kitchen but also wants to save money for retirement. His retirement account is expected to earn 5% interest every year and redoing his kitchen would cost 15,000 What is the opportunity cost for choosing to save the money for retirement? (1 point) 5% of the initial 15,000 in the first year, plus 5% of the new total in that account in the second year, plus 5% more in the third year,and so on until he withdraws the money 15,000 5% the benefit he would get from redoing his kitchen

Solution4.0(241 votes)

Answer

Explanation

Similar Questions

The risk management alternative is most appropriate when a risk is too great and activity associated with the risk should be eliminated. A Risk avoidance B Risk transfer C Risk reduction D Risk retention

Often the most difficult aspect of an emergency situation is chemical hazards. explosion hazards. fire prevention and control. coordination and communication.

For recordkeeping purposes, work activities the employee regularly performs at least once per week are considered an employee's duty list skill set job tasks routine functions

Which type of insurance covers a coach if sued for negligence in a civil case? Accident Insurance Liability Insurance Catastrophic Insurance General Insurance

If you are living "behind" or paycheck -paycheck. How can that effect your financial life? You will never be behind on bills if you have a job you love. You have financial stress and never get to really enjoy a financially sound life. You have trouble investing all your money because of the profit.

The tailored strategy "Focus on low-cost, decentralized capacity for predictable demand" follows which risk mitigation strategy? Select one A. Get redundant suppliers. B. Increase capacity. C. Increase responsiveness D. Increase inventory.

Review Question Which of the following pieces of information should you give to a dispatcher after calling emergency responders? Who was hurt or affected by the emergency Where your workplace is located When the emergency began All of the above None of the above

__ is the primary revenue source in the eSports industry. Sponsorship Equipment Advertising Ticketing

Which of the following is an unintended consequence of a binding minimum wage? Select an Answer A. A binding minimum wage encourages firms to look for ways to substitute capital for workers. B. A binding minimum wage can create unemployment. C. A binding minimum wage lowers the quantity of labor demanded. D. all of the above

TRUE OR FALSE:Guests may place online orders using the app or Whataburger website. VERDADERO O FALSO: Los clientes pueden realizar pedidos en línea usando la aplicación o el sitio web de Whataburger. True Verdadero False Falso