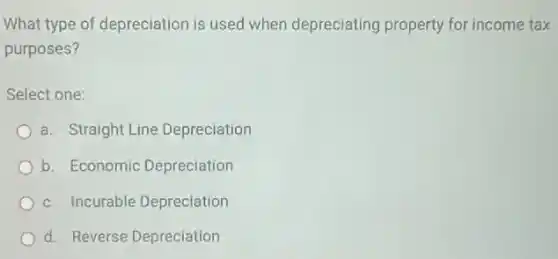

What type of depreciation is used when depreciating property for income tax purposes? Select one: a. Straight Line Depreciation b. Economic Depreciation c. Incurable Depreciation d. Reverse Depreciation

Solution4.7(258 votes)

Answer

Explanation

Similar Questions

If you invest $\$ 1,000$ at the beginning of each of the next 3 years at $8\% $ how much would you have at the end of year 3? $\$ 3417.10$ $\$ 3506.11$ $\$ 3783.26$ $\$ 3818.70$

Exclusive Authorization and Right to Sell Listings require: both a definite end time and date. only a definite end time. only a definite end date. neither a definite end time nor date.

Your income tax withholding is dependent on: your age and educational qualification. the number of deductions claimed by your spouse. your income level and the number of withholding allowances you have claimed. the number of standard deductions you have claimed. the number of withholding allowances allowed by your employer.

Which of the following Is the most time -consuming and resource -Intensive task of any police agency? Multiple Choice patrol Investigation traffic enforcement drug enforcement

Your investment advisor wants you to purchase an annuity that will pay you $\$ 25,000$ per year for 10 years. You require a $7\% $ return. The present value annuity factor at $7\% $ for 10 years is 7.0236. What is the most you should pay for this investment? a) $\$ 201,000$ b) $\$ 49,179$ C) $\$ 250,000$ d) $\$ 225,682$ e) $\$ 175,590$

Question 8 (10 points) Public policy is what the government does or does not do to and for its citizens. True False

The interest revenue on a $\$ 32,000,8\% $ 9 month note receivable is $\square $

They do not charge interest 10. Select the statement below that accurately describes a characteristic of a credit card. You owe the same payment every month You must have money deposited into a checking account to use the credit card for purchases Making full payments on-time every month is the only way to avoid interest charges 1 poin

Q15. Sue receives a base salary of $\$ 90$ weekly plus a $12\% $ commission on all sales.Sue had $\$ 3,000$ in sales this week.How much did she make total? $\$ 375$ $\$ 450$ $\$ 480$ $\$ 510$ $\$ 525$

Los Factores que contribuyen a generar caidas o fatalidades en el uso de escaleras incluyen: (marca todos las que correspondan) Puntos criticos de funcionamiento Equipamiento Defectuoso Resbalarse en los peldaños o escalones estirarse por sobre el alcance de la escalera