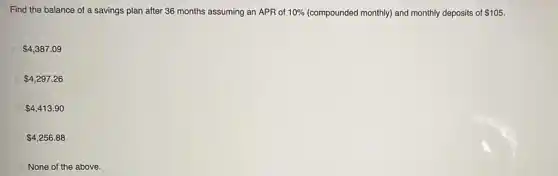

Find the balance of a savings plan after 36 months assuming an APR of 10% (compounded monthly) and monthly deposits of 105. 4,387.09 4,297.26 4,413.90 4,256.88 None of the above.

Solution4.1(273 votes)

Answer

Explanation

Similar Questions

26. A __ financial goal takes up to two years to reach. Five-level Short-term Medium-term Long-term

How can you use the total revenue test to determine elasticity? You know a product is elastic if the price decreases as the total revenue goes down. You know a product is inelastic if the price increases as the total revenue goes down. You know a product is inelastic if the price decreases as the total revenue goes up. You know a product is elastic if the price increases as the total revenue goes down.

Which of the following is not an approach to classifying market entry? A Re-segmenting an existing market B Attacking a new market C Attacking an existing market D ) Creating a new market

With no one specific strategy being the best, it is important that managers take all of the following actions except for which one? ensure marketing can support the strategy have confidence in the business-level strategy offer clear logic for pursuing the strategy have an offering that matches the strategy

Question 1: Think of an example from your own life of a deferral (either prepaid expense or unearned revenue). How would you explain its accounting treatment? Question 2: How do deferrals help accountants apply the matching principle?

Collins believes that business and ethics are contradictory. Good ethics is antithetical with good management True False

Which of the following rating errors occurs when a manager gives low ratings to all employees by holding them to an unreasonably high standard? A severity error A halo error A leniency error A horns error

Which of the principles of AICPA Code of Conduct is most related artilce 5 of the California Accountancy Act? Responsibilities Due care The public interest Objectivity and independence Integrity Scope and nature of services

Multiple Select Question Select all that apply What are examples of economic factors that can help or hinder business? Taxation Contract enforcement Competition

How did Dan Price blend social responsibility with Gravity Payment's mission to provide high- service, low-cost credit card processing, according to the case "Corporate Social Responsibility at Gravity Payments"? The CEO donated 15 percent of profits to charity. He provided free in -kind services to small businesses. Price implemented a pay equity plan for all employees. Price donated his 13 -year-old Audi to a local shelter.