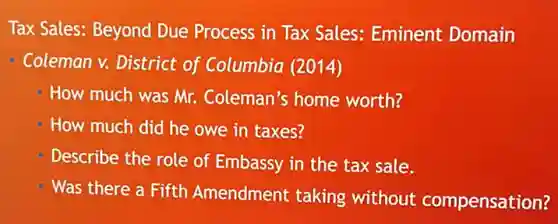

Tax Sales: Beyond Due Process in Tax Sales: Eminent Domain Coleman v. District of Columbia (2014) How much was Mr.Coleman's home worth? How much did he owe in taxes? Describe the role of Embassy in the tax sale. Was there a Fifth Amendment taking without compensation?

Solution4.7(147 votes)

Answer

Explanation

Similar Questions

Reading Excerpt 1: The Constitution - Article I,Section 2 The House of Representatives shall be composed of Members chosen every second Year by the People of the several States, and the Electors in each State shall have the Qualifications requisite for Electors of the most numerous Branch of the State Legislature.No Person shall be a Representative who shall not have attained to the Age of twenty five Years, and been seven Years a Citizen of the United States, and who shall not, when elected, be an Inhabitant of that State in which he shall be chosen. Structure and Qualifications of the House: According to Article I,Section 2, what are the key qualifications and structure of the House of Representatives? Answer: __ Reading Excerpt 2: The Constitution - Article I Section 3 The Senate of the United States shall be composed of two Senators from each State, chosen by the Legislature thereof; (Th preceding words in parentheses were superseded by the 17th Amendment,section 1.) for six Years,and each Senator shal one Vote. No Person shall be a Senator who shall not have attained to the Age of thirty Years, and been nine Years a Citizen of the States, and who shall not, when elected, be an Inhabitant of that State for which he shall be chosen. tructure and Qualifications of the Senate: cording to Article I,Section 3, what are the key qualifications and structure of the Senate? swer: __

The chart below lists the constitutional requirements for serving as a member of the Florida House of Representatives. . Be 21 Years Old ? - Live in the district of Florida represented Which constitutional requirement completes the chart? Have been a resident of Florida for two years Have previcusly served in local government Bea natural born citizen Havelived in the United States for 14 years

Controls through legislative actions and their judicial interpretation on conflict of interest discrimination, nepotism and private use of public resources are classified in which of the following 2. Professional norms b. Public opinion c. Virtue d. Laws

Which of the following is NOT a basis prohibited by Federal civil rights laws? Behavior Race Disability Sex

Which of the following is not an approved record destruction method? Data Deletion Data Archival Data Transfer

7. Professional providers must provide? a. Names of hospitals where physicians have admitting privileges b. Years a physician has been practicing c. Accreditation status d. All of the above

If someone is convicted of a crime during a criminal trial, should they also be subjected to a civil suit regarding the same matter? Would this fall under the double jeopardy clause?Explain your answer in detail. "You must respond to 2 students posts o receive full credit. You must start a thread before you can read and reply to other threads

Who makes the legally enforceable promises in a unilateral insurance policy? A. Insurance company B. Beneficiary C. Applicant D. Insured

3. Why is the Sixth Amendment so important if someone is arrested? __

The juvenile justice system emphasizes rehabilitation more than punishment. True False