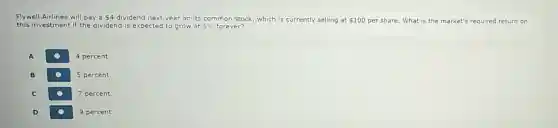

Flywell Airlines will pay a 4 dividend next year on its common stock, which is currently selling at 100 per share. What is the market's required return on this investment if the dividend is expected to grow at 5% forever? A 4 percent. B 5 percent. C 7 percent. D 9 percent.

Solution4.6(169 votes)

Answer

Explanation

Similar Questions

What percentage of Planet Popcorn's revenue comes from the popcorn business , according to Marcus? $80\% $ $50\% $ $60\% $ $100\% $

Multiple Choice Question During the necession that began in December of 2007, Amerkens reduced their overell charttable giving by approachinately __ percent from level's price to the recession. 5 10 20 50 70

itempts $\square $ $\square $ $\square $ 10. Problems and Applications Q10 Consider public policy almed at smoking. Studies Indicate that the price elasticity of demand for cigarettes is about 0.2. If a pack of dgarettes currently costs $\$ 5$ and the government wants to reduce smoking by $10\% $ It should increase the price by $50\% $ If the government permanently increases the price of cigarettes the effect on smaking 1 year from now will be smaller than the effect 3 m from now. Studies also find that teenagers have a higher price elasticity of cemand than do adults. Which of the following statements are consistent with this result? Check all that apply. It is legal for adults to consume alcohal so many choose to spend their money on that good rather than cigarettes. Adults are more likely to be addicted to cigarettes. Teenagers do not have as much income as adults, so they are more price sensitive. Average /3

Farragut Company uses ABC to account for its chrome wheel manufacturing process. Company managers have identified four manufacturing activities that incur manufacturing overhead costs materials handling, machine setup, insertion of parts and finishing. View additional information Read the reovirements. Requirement 1. Compute the cost allocation rate for each activity. First identify the formula, then compute the rate for each activity Activity cost Total activity overhead (est) Total activity allocation base is allocation rate Mat handling $\square +\square =\square por\quad port$

a. Stockholders invested cash in the business for common stock. b. Paid a cash dividend. c. Received cash from a customer who had previously been billed for services performed.

The Nalure of cires Income (L0 2.1) lane is a rooflng contractions. Jane's friend merded a new roof but did not have the cash lo piry. lare's friend Instead (wild with a used truk that Jane could us in har roofing busina ". The truck had originally cost the friend $\$ 17,500$ but It was ipitly used and only worth $56,000$ Jane Uit not actually need the truck and 'ended up selling it to a used tar dealar for $45,200$ a few months laler. What amount of gros income Jane must resognize as a itsult of the truck porment. $\square $ why? There $\square $ moception in the law for nencash temsirorived In excluing for services.

Question 25 (1 point) Dylan needs to insert the date and time in his document. What should he do? Click the Insert Date and Time button and select the desired option. Click the Cross-reference button. Click the Table button and select the desired option. Click the Link button and select the desired option.

asing a purchases journal LO6 The purchases journal for Electronic Source is given in the Working Papers. Instructions: Use page 9 of the purchases journal to journalize the following transactions completed during September of the current year. The purchase invoices used as source documents are abbreviated as P. Save the purchases journal to complete Problem $9-3$ Transactions: Sept. 2. Purchased merchandise on account from Henson Audio, $\$ 980.00.P354$ 5. Purchased merchandise on account from Peterson Electronics, $\$ 2,450.00.P355$ 13. Purchased merchandise on account from Atlanta Systems, $\$ 2,845.00.P356$ 19. Purchased merchandise on account from Lester Corporation, $\$ 680.00.P357$ 22. Purchased merchandise on account from Masonville Music, $\$ 4,890.00.P358$

According to Smith, incentives form the bedrock upon which markets are built: Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a True b False Saved

Cost certification programs offer two sections: an online portion and which of the following? a face-to-face skills portion a phone interview a video component a live journal or blog