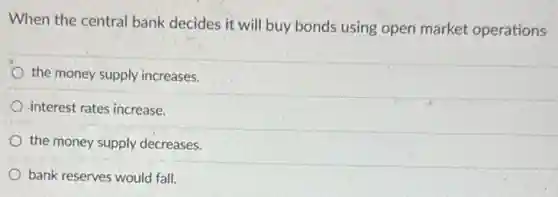

When the central bank decides it will buy bonds using open market operations the money supply increases. interest rates increase. the money supply decreases. bank reserves would fall.

Solution4.2(364 votes)

Answer

Explanation

Similar Questions

A strategic commitment by top management to change its approach to business in order to make quality a guiding factor in everything the company does is known by it's abbreviation: ROI SQC TQM JIT

Ceiling fan boxes must be marked with the maximum weight to be supported when they are rated to support more than __ 20 Ibs 25 Ibs 30 Ibs 35 lbs

If the lender/servicer does not get involved in setting the price of the property at the time of listing, how should the listing agent price the property? $\$ 10K$ below fair market value $\$ 15K$ above fair market value At 93 percent of the median list price of current comparable properties At a price that garners an offer from a qualified buyer with a realistic chance of closing

Sales promotion's greatest strength is in creating strong desire and purchase intent True False

Advertising increases as a product enters the decline stage of its life cycle True False

The business analyst serves as an intermediary between the data scientist and which of the following? the shareholders decision maker board of directors the chief financial officer

What inventory method(s)match the cost of goods sold (COGS) with the sales revenue for the same goods? Freight in method Periodic method Both periodic and perpetual method Perpetual method

Personal selling, unlike other promotional mix elements, is independent of the Internet True ) False

The US follows what type of tax system? Regressive Tax No Tax Flat Tax Progressive Tax

A fully funded emergency fund would be $\$ 1,000$ 5 years worth of your monthly expenses. 3 to 6 months worth of your monthly expenses. 1 to 2 months worth of your monthly expenses.