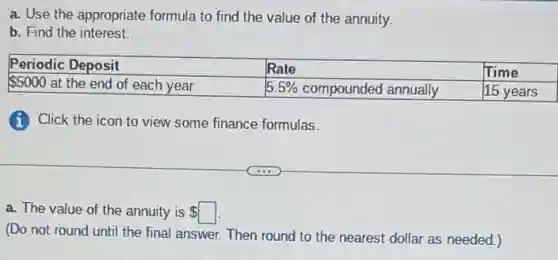

a. Use the appropriate formula to find the value of the annuity. b. Find the interest. Periodic Deposit & Rate & Time 5000 at the end of each year & 5.5 % compounded annually & 15 years (i) Click the icon to view some finance formulas. a. The value of the annuity is square (Do not round until the final answer. Then round to the nearest dollar as needed.)

Solution4.4(302 votes)

Answer

Explanation

Similar Questions

Program staff are to be trained on CACFP annually. New staff are to be trained upon hire and annually thereafter. True False

Multiple Choice Question If you compare the 15 most populous states on the amount of revenue raised per $1,00 of personal income, Texas ranks __ amount of revenue raised ed per $\$ 1,000$ second to highest near the top fourth lowest in the middle

What is a barrier to family planning?Select all that apply. Cost Services only targeting youth Insurance issues Transportation

Enrollment forms are required for: Check all that apply. Adult day services At risk after school Emergency shelters Childcare

People with unsatisfied wants and needs who have both the resources and the willingness to buy. A Marketing B Marketing mix C Consumer Market D Market

Question 20/Multiple Choice Worth 5 points) (02.04 LC) What is the relationship between a lower nominal rate and a higher real interest? Decreased purchasing power Increased purchasing power Increased production Decreased production

The law of "diminishing returns" applied to all sectors except the __ sector. A. energy supply B. foresty C. buildings D. transport E. industry

When is it especially important for an employee on duty to appear in full uniform? A. During peak business hours B. When managers are present C. When in a public area of the property

If $\$ 5000$ is borrowed at a rate of $6.75\% $ interest per year, compounded quarterly, find the amount due at the end of the given number of years. (Round your answers to the nearest cent.) (a) 3 years $\$ \square $ (b) 5 years $\$ \square $ (c) 7 years $\$ \square $

A business would like to know how their customers feel about a new product that was recently launched. They randomly select 1250 customers from their database and send them a survey, but only 513 respond. Which is the major type of bias present in this survey?nonresponse bias True False