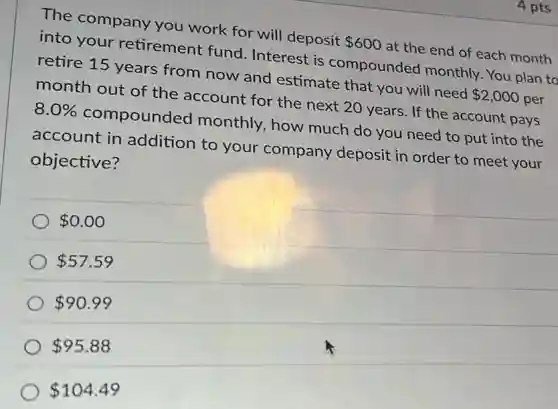

4 pts The company you work for will deposit 600 at the end of each month into your retirement fund Interest is compounded monthly. You plan to retire 15 years from now and estimate that you will need 2,000 per month out of the account for the next 20 years. If the account pays 8.0% compounded monthly, how much do you need to put into the account in addition to your company deposit in order to meet your objective? 0.00 57.59 90.99 95.88 104.49

Solution4.5(228 votes)

Answer

Explanation

Similar Questions

Samuel needs to decrease his expenses. To which category should he make cuts first? Entertainment Housing Utilities Transportation

If the government purchases multiplier is 4 and a change in government spending leads to a $\$ 500$ million decrease in aggregate demand, we can conclude that government spending decreased by \$125 million. $\$ 125$ taxes increased by $\$ 500$ million. taxes decreased by $\$ 100$ million. government spending decreased by $\$ 2,000$ million.

As a step in the accounting cycle, __ involves the recording of business transactions. Multiple Choice bookkeeping marketing economics ouditing

Read the scenario: Neil notices that one public school in his town has brand- new computers and tablets for all the students. His public school, on the other hand, has outdated technology. What is the most effective way for Neil to be an advocate for the school? post a political cartoon about the school board to his social media accounts write to the government officials in charge of school funding to raise the issue ask the principals and teachers at the other school if they are willing to share the technology

True or False Question Entrepreneurs typically do not have the right to fire employees. True False

1. Which of the following would BEST define the role of command at a multiple casualty incident? The individual who is responsible for coordinating all activities. The individual who determines ; how best to treat the patients. The individual who handles all finances and administration. The individual with the highest level of medical training.

True or False - There are no limits to what customers are willing to pay. Determine if the above statement is accurate by selecting true or false. Answer true or false. False True

Aiko estimates she will need $\$ 35,000$ for a new computerized office system. Aiko decides to put aside the money today so that it will be available in 10 years. Pod Bank offers her $8\% $ interest compounded semiannually. How much must Aiko invest today to have $\$ 35,000$ in 10 years? Aiko invest $\square $

Reinard Company has purchased a piece of equipment that cost $\$ 700,000$ with an average amount invested of $\$ 100,000$ and has an expected life of 8 years. The company's expects average operating income from the equipment to be $\$ 10,000$ per year. What is the accounting rate of return (ARR)? $14\% $ $5\% $ $10\% $ $2\% $

Multiple Select Question Select all that apply The three redistributive effects of inflation include: consumption effects wealth effects price effects production effects income effects