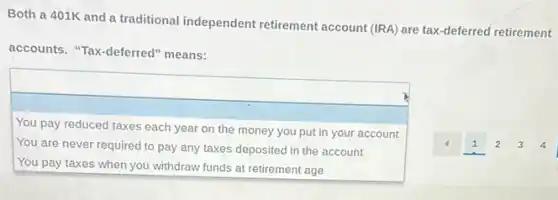

Both a 401K and a traditional independent retirement account (IRA) are tax-deferred retirement accounts. "Tax-deferred"means: square square You pay reduced taxes each year on the money you put in your account You are never required to pay any taxes deposited in the account

Solution4.5(300 votes)

Answer

Explanation

Similar Questions

Demand-pull inflation is caused by: A increases in wages, pushing prices higher. B increases in aggregate demand. C decreases in aggregate supply. D consumers demanding better quality, which increases costs.

The DIM process is associated with risk management. True False

Fill in the Blank Question The money multiplier is the amount by whi $\$ 1$ change in $\square $ will change the money supply. by which a

A firm is producing 1,000 units at a total cost of $\$ 5,000$ When it increases production to 1,001 units, its total cost rises to $\$ 5,008$ For this firm, __ a. marginal cost is $\$ 8$ and average variable cost is $\$ 5$ b. marginal cost is $\$ 5$ and average total cost is $\$ 8$ c. marginal cost is $\$ 8$ and average total cost is $\$ 5$ d. marginal cost is $\$ 5$ and average variable cost is $\$ 8$

Beginning in February 1928 and lasting through most of 1929, the American stock market saw brokerage firms restrict credit to those buying stocks. saw the number of shares traded daily soar. rapidly lost value. slowly declined in value. saw the average price of stocks rise slightly.

Question Jamal bought a rare baseball card for $\$ 245$ dollars. He then resold it for $\$ 750$ What markup rate did Jamal use to calculate the sales price of his baseball card? Write your answer as a percentage rounded to the nearest whole number. Provide your answer below: $\square \% $

For an investor with little time or desire to follow the markets a life cycle fund would be an appropriate choice for their retirement savings. True False

The Fed can help the economy by controlling: bailout legislation. interest rates. exchange rates. the president's economic agenda.

All RIGHT documents contain all of the following, EXCEPT: Sections broken out by bold, purple headings Release and Entry instructions Who can complete required documentation An edit function to update information on the RIGHT document

One of the most controversial forms of government involvement in the economy is through microeconomics. True False