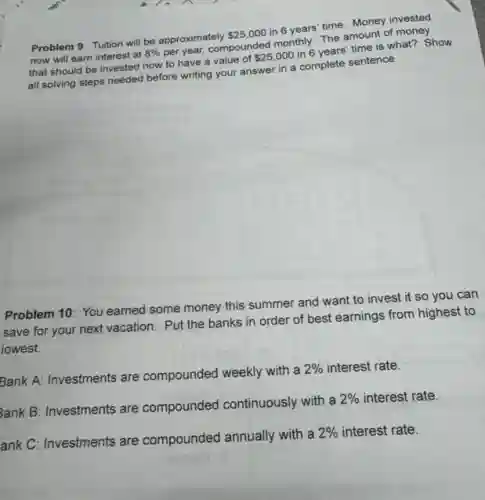

Problem 9: Tuition will be approximately 25,000 in 6 years' time Money invested now will earn interest at 8% per year, compounded monthly The amount of money that should be invested now to have a value of 25,000 in 6 years' time is what? Show all solving steps needed before writing your answer in a complete sentence. Problem 10: You earned some money this summer and want to invest it so you can save for your next vacation. Put the banks in order of best earnings from highest to lowest. Bank A: Investments are compounded weekly with a 2% interest rate. 3ank B: Investments are compounded continuously with a 2% interest rate. ank C: Investments are compounded annually with a 2% interest rate.

Solution4.0(321 votes)

Answer

Explanation

Similar Questions

A selected graphic in a worksheet had the border corner circle dragged outward What happened to the graphic? The graphic was resized to be smaller. The graphic's style was changed. The graphic's layout has changed. The graphic was resized to be larger.

According to the case "Good companies achieve their strategic goals. Great companies modify their strategic plans as goals are met, always looking to the future and positioning themselves to remain in front." In order to remain in front Samsung __ boosts its innovation investment budget constantly cuts costs to boost profits discontinues products that don't sell well creates new products every year

A customer success program is not an appropriate level of relationship with all of a firm's customers. A True B False

Which of the following statements are true about an effective multiple- rescuer response?Select three answers. Team members should wait for the team leader to assign roles and give direction on what actions to take. Each team member should arrive on scene and be able to perform any role necessary. Critical thinking and communication are essential. Team members should anticipate the next actions other rescuers will take. Team members should continue in their current roles if they do not want to move when the compressor

Logistics costs drive a firm's focus on speed and consistency. A True B False

__ is the hardware and software that facilitates information exchange between the systems and physical infrastructures within the firm and between supply chain partners. A Reverse logistics B Consumer connectivity C Communication technology D Blockchain

Which of the following is not a form of debt financing? A loan from the Small Business Administration (SBA) Crowdfunding Personal credit cards A bank loan Borrowing from family and friends

Multiple Select Question Select all that apply Explain how to add adjustments to a work sheet when more than one adjustment is required: The adjustment can be combined into one adjustment amount. These adjustments are omitted from the work sheet. The adjustment can be added to a blank line. C Need help? Review these concept resources. Read About the Concept

A Type 1 Excludes note is a pure Excludes note. True ) False

Chris operates the Beans's Brew chain of coffee stands. "Bean's Brew" is . a lingo. a trade secret. a service mark. a trade name.