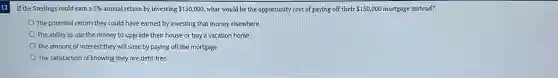

If the Sterlings could earn a 5% annual return by investing 150,000 what would be the opportunity cost of paying off their 150,000 mortgage instead? The potential return they could have earned by investing that money elsewhere The ability to use the money to upgrade their house or buy a vacation home The amount of interest they will save by paying off the mortgage The satisfaction of knowing they are debt-free

Solution4.5(242 votes)

Answer

Explanation

Similar Questions

If the drowee bank keeps the original checks and provides its customers with images of the cancelled checks on pages of a paper or electronic bank statement this is called __ Multiple Choice account aggregation check conversion. check truncation. screen scraping

Question 10 (1 point) What are the approaches to inventory that businesses can consider? Minimizing inventory levels to reduce costs and storage space. Outsourcing all inventory management tasks to suppliers. Maximizing inventory levels to ensure no shortages occur. Increasing inventory levels to take advantage of quantity discounts.

Under a firm commitment agreement, Zeke Company went public and received $\$ 30.50$ for each of the 7 million shares sold. The initial offer price was $\$ 33$ and the stock rose to $\$ 35.36$ The company paid $\$ 560,000$ in direct flotation costs and $\$ 215,000$ in indirect costs. What was the flotation cost as a percentage of funds raised?

Which of the following is not part of data governance? a. Establishing and monitoring data policies b. Promoting the sale of enterprise data C. Assigning data decision rights and accountabilities for data d. Ensuring control and accountability for enterprise data

How much will $\$ 1,500$ be worth in 6 years at $8\% $ p.a. simple interest?

What does it mean if a resource is scarce?Give a real-life example of a resourcein your life that is scarce.

Empowering the frontline involves not only giving the employees the authority to act but also the responsibility to recognize and attend to customer needs and obligation to act. True False

If a bank has a required reserve ratio of 10 percent and there is $\$ 1,000$ in deposits, what is the maximum possible amount that this bank could lend out? $\$ 9,000$ $\$ 900$ $\$ 10,000$ $\$ 100$

Based on the Circles for a Successful Value Proposition framework, when should a firm reengineer its product to stop providing certain benefits? When customer needs are met by the benefits in question, but are not met by benefits provided by competitors When customers express little need or desire for the benefits in question When customers are unaware that the product meets one of their needs When customer needs are met by the benefits in question as well as by competitors

What components of GDP would each of the following transactions affect? How does it affect the component; Le.does the component increase or decrease?[Remember: $GDP=C+I+G+(X-M)]$ 1. A family buys a new kitchen appliance. 2. James buys a new house. 3. You buy a pizza. 4. California repaves Highway 101. 5. A couple buys a bottle of wine from France.