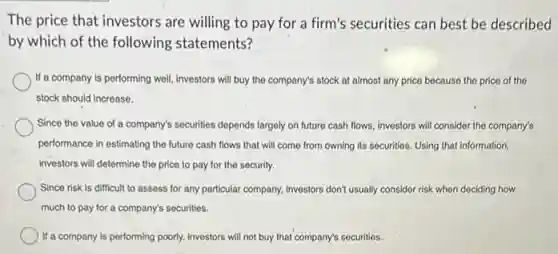

The price that investors are willing to pay for a firm's securities can best be described by which of the following statements? If a company is performing well, investors will buy the company's stock at almost any price because the price of the stock should increase. Since the value of a company's securities depends largely on future cash flows, investors will consider the company's performance in estimating the future cash flows that will come from owning its securities. Using that information, investors will determine the price to pay for the security. Since risk is difficult to assess for any particular company, Investors don't usually consider risk when dociding how much to pay for a company's securities. ) If a company is performing poorly, investors will not buy that company's securities.

Solution4.7(283 votes)

Answer

Explanation

Similar Questions

Multistate income tax planning can be effective for the taxpayer because: Different states use different definitions of taxable income. State income tax rates generally are steeply progressive. Both a. and b. Neither a. nor b.

Sean will need to figure out both his department's and his company's culture in order to understand how he should communicate in his new job. Which of the following is not a true statement about organizational culture? Multiple Choice Reading the company's n mission statement is the most effective way to learn the culture It can take quite a while to learn the culture of a company. While company leoders can influence the culture, they cannot fully control it. The company culture is influenced by the many acts of communication that take place within it each day

The house edge is the expected value to the casino. False True

Which recruiting source best suits highly specialized jobs with low geographical constraints but entails a long lead time? Local Newspapers National Newspapers Magazines Directories

12. For a linear demand curve, the elasticity changes at any point. True False

In the context of the Sarbanes-Oxley Act,the biggest concerns are linked to __ A immigrant workers B executive compensation and benefits C employee productivity D workplace safety

Multiple Select Question Select all that apply How can a service professional demonstrate patience when dealing with customers? Actively listen to customer responses. Respond to all customers in the same way. Consider each customer's needs and expectations. Take enough time to ask questions.

Which type of factory-built home is delivered to the site in attachable sections and set on a permanent foundation? Select one: a. Amanufactured home b. Amodular home c. Apanelized home d. Aprecut home

If the two totals of a trial balance are not equal, it could be due to A an error in determining the account balances, such as a balance being incorrectly computed B recording the same transaction more than once C recording the same erroneous amount for both the debit and the credit parts of a transaction A D failure to record a transaction

The welding workforce (supply) is expected to grow due to a state program that has increased the access of the vocational education programs necessary to become proficient in the profession. Unfortunately, the price of tools to be a welder have gone up. What impact will this development have on the supply of welders? (1 point) The supply of welding will increase. It is impossible to tell. The supply of welding will decrease. The supply of welding will be unaffected.