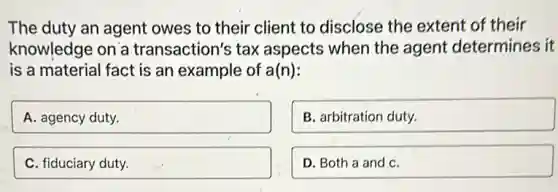

The duty an agent owes to their client to disclose the extent of their knowledge on a transaction's tax aspects when the agent determines it is a material fact is an example of a(n): A. agency duty. B. arbitration duty. C. fiduciary duty. D. Both a and C.

Solution4.0(195 votes)

Answer

Explanation

Similar Questions

How many partner countries does Interpol help in policing? (1 point) 98 155 194 236

Which of the following is a general principle that Huemer offers in response to the "Harm to Users Argument"? The state should never interfere with people exercising their own free will. It is unjust for the state to punish people without having a good reason for doing so. The state should prohibit activities that are harmful to people. Both (a) and (b) All of the above

Using the United States v. Nixon source and your knowledge of Civics, determine how the Supreme Court's decision affected the power of the President. It increased the requirements for prior restraint It reduced the enforceability of executive orders It changed the process for impeachment It limited the extent of executive privilege

Your buyer is worried that after she closes on her property, she'll find out someone else has a claim to its ownership. What can reassure her?

As required by DHS Directive $045-05$ , which of the following are examples of remedial actions taken by ICE upon awareness of an off-duty reportable contact that was not reported by a LEO? Select all that apply. A) ICE will not take any remedial action for the first instance of a LEO's failure to report. B) ICE will review the situation and the factors underlying the failure to report and take appropriate action, including discipline for misconduct. C) ICE policies will Include penalties for a failure to report off-duty reportable contact. D) ICE will immediately terminate the LEO's employment.

Basketball is permitted to participate infour scrimmages before the first contest. True False

Question 14 Since the 1980's we've had automated fingerprint identification systems. True False Question 15 Local law enforcement are usually the first responders to a terrorist crime scent: True False 1 pts 1 pts

(1) 5. A lease is a legally binding contract so it is important to read and understand the terms and conditions. Leases are also required to follow a state's rental laws but can vary in what they permit you and your landlord to do or not do. Which term is usually NOT a part of a typical lease? mortgage lender rent amount and frequency of payment security deposit and return policy utility services (1) 6. Apartments are frequently a high risk for theft because there are many people living within a confined area. __ will provide you with the additional security needed to protect your property. renter's insurance security deposits rights of entry co-signatures

All human rights are linked by the common premise that the Individual possesses inherent dignity deserving of protection. When the human rights of one person are violated, the common thread of humanity frays. True False

Under which of the following conditions would a principal or employer be liable for the tort of an agent or employee: both a and b are correct. the tort was authorized by the principal. the tort was not authorized by the principal. the tort occurred within the scope of employment. none of the other choices are correct.