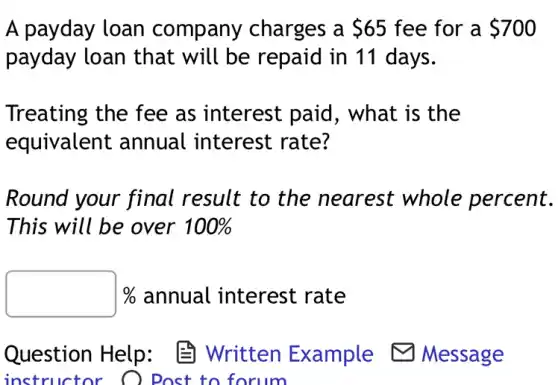

A payday loan company charges a 65 fee for a 700 payday loan that will be repaid in 11 days. Treating the fee as interest paid , what is the equivalent annual interest rate? Round your final result to the nearest whole percent. This will be over 100% square % % annual interest rate

Solution4.5(141 votes)

Answer

Explanation

Similar Questions

You should never remove money from the till before completing which of the below transactions? WUPOS POS lottery terminal all of the above

Steve is gathering some information for a project for a specific Client that includes PHI data. One of the data sets includes full Social Security Number (SSN)He plans on masking the SSN before emailing the data to the Client. After sending the data, Joe realizes he forgot to mask the SSN and he didn't encrypt the email he sent. What does Steve need to do to correct the situation? A. Nothing since the SSN's are the members of the services the Client is providing. B. Notify his manager and ask what steps he needs to take to correct the incident as well as how to report it to Corporate Security. C. Delete it from his sent email box.

Current Attempt in Progress The cumulative effect of the declaration and payment of a cash dividend on a company's financial statements is to increase total expenses and total liabilities. decrease total assets and stockholders' equity. decrease total liabilities and stockholders' equity. increase total assets and stockholders' equity.

Jane is working on an important project that includes combining different PI elements together on one Excel spreadsheet. The project is taking longer than she expected and decides to email the data needed for the report to her personal email address so she can work on the project over the weekend. Is this an acceptable course of action? A. Yes, she has to meet her deadline. B. Yes, it's ok to forward the documents to her personal email since it's password protected. C. No, doing so could put the PI at risk of exposure.

You put a check for $\$ 34.72$ and a check for $\$ 92.67$ on a deposit slip and want $\$ 15$ cash back. What is your total deposit? $\$ 113.99$ $\$ 122.33$ $\$ 112.39$ $\$ 121.93$

Fall Hazards in Construction Which of the following construction activities has an especially high rate of occupational injuries and illnesses related to fall hazards? Electrical work Plumbing Roofing and siding Painting and interior finishing work

3. Lauzy favors problem-solving techniques that allow teams of workers to freely identify and discuss possible solutions to a problem without having their ideas censored. Which of the following is a problem solving technique that Lauzy is likely to suggest to his managers? A. SWOT analysis B. PERT analysis C. brainstorming D. controlling

What is the best definition of credit? Goods, services, or money received in exchange for a promise to pay a definite sum of money at a future date. An individual's character, capital capacity, collateral and conditions. Money allocated to a specific account for future use by the consumer without borrowing. The ability and willingness of an individual to pay back a loan as perceived by the lender.

Market failure describes a situation in which the market itself __ in a way that balances social costs and benefits. avoids externalities fails to allocate resources efficiently remains outside the transaction incurs the costs outside the production process

Use context clues from the sentence below to determine the meaning of the word deficits. Governments finance deficits by borrowing money. low scores not enough money physical handicaps