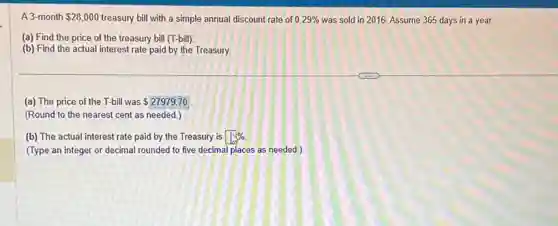

A 3-month 28,000 treasury bill with a simple annual discount rate of 0.29% was sold in 2016.Assume 365 days in a year. (a) Find the price of the treasury bill (T-bill) (b) Find the actual interest rate paid by the Treasury (a) The price of the T-bill was 27979.70 (Round to the nearest cent as needed.) (b) The actual interest rate paid by the Treasury is square % (Type an integer or decimal rounded to five decimal places as needed.)

Solution4.3(147 votes)

Answer

Explanation

Similar Questions

A sailboat costs $\$ 31,503$ You pay $20\% $ down and amortize the rest with equal monthly payments over a 13-year period. If you must pay $6.6\% $ compounded monthly, what is your monthly payment? How much interest will you pay? Monthly payments: $S\square $ (Round to two decimal places.)

Private markets: A are generally efficient B provide freedom for consumers and producers C will sometimes fail to produce the efficient quantity D All of the above

6. The price charged by a firm in a perfectly competitive market always equals its: total revenue. marginal cost. marginal revenue. average cost.

__ are NOT likely to stop suddenly. Rideshare vehicles Buses Taxis $\square $

R-450a is an acceptable substitute for use in new household refrigerators and freezers under SNAP. This means new household refrigerators and freezers can be factory charged with R- .450a. Select one: True False

What percentage of B2B executives report that the information they found through their social media engagements had influenced buying their decisions? less than 10 percent approximately 25 percent around 50 percent over 90 percent

Suppose that in 2018 and 2019, households and firms reduced desired expenditures. During the same period inflation fell and unemployment rose. Neither the change in inflation nor the change in unemployment are consistent with what a given short-run Phillips curve implies. Both the change in inflation and the change in unemployment are consistent with what a given short-run Phillips curve implies. The change in unemployment,but not the change in inflation, is consistent with what a given short-run Phillips curve implies. The change in inflation but not the change in unemployment, is consistent with what a given short-run Phillips curve implies.

> Financial Statement Case $1-1$ This and similar cases in later chapters focus on the financial statements of a real company-Starbucks Corporation, a ampon premier roaster and retailer of specialty coffee. As you work each case, you will gain confidence in your ability to use the financial statements of real companies. Visit http://www.pearsonhighered .com/Horngren to view a link to the Starbucks Corporation Fiscal 2013 Annual Report. Requirements 1. How much in cash (including cash equivalents)did Starbucks Corporation have on September 29, 2013? 2. What were the company's total assets at September 29, 2013? At September 30, 2012? 3. Write the company's accounting equation at September 29., 2013, by filling in the dollar amounts: $Assets=Liabilities+Equity$ 4. Identify total net sales (revenues) for the year ended September 29, 2013 . How much did total revenue increase or decrease from 2012 to 2013? 5. How much net income (net earnings) or net loss did Starbucks earn for 2013 and for 2012? Based on net income, was 2013 better or worse than 2012? 6. Calculare Starbucks Corporation's return on assets for the year ending September 29, 2013. 7. How did Starbucks Corporation's return on assets compare to Green Mountain Coffee Roasters, Inc's return on assets?

2. Yes or No Should you contact the Helpdesk Team personnel directly for helpdesk questions? Yes ) No

What is the purpose of a hospital's incident command system? A. Assign blame after incidents B. Provide disciplinary action D C. Organize roles and communication D. Limit access to critical supplies