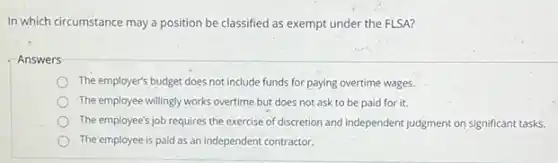

In which circumstance may a position be classified as exempt under the FLSA? Answers The employer's budget does not include funds for paying overtime wages. The employee willingly works overtime but does not ask to be paid for it. The employee's job requires the exercise of discretion and independent judgment on significant tasks. The'employee is paid as an independent contractor.

Solution4.0(245 votes)

Answer

Explanation

Similar Questions

4. The Sixth Amendment states you have the right to an attorney. How does the case Gideon v.Wainwright add to that right?

Deviation from the accepted standard of care that results in further injury to the person. standard of care duty to act negligence abandonment

Several generic standards should be met for any selection process. One such measure is validity, the extent to which a performance measure assesses all the relevant--and only the relevant.-aspects of job performar ce. Another is reliability, which is the extent to which a messurement is free from random error. A relable measurement generates consistent results. Reliability is a necessary but insufficient standard for validity.A thorough understanding of validity helps determine the underlying rationale of many legal standards Consmart University needs to hire two professors: an English instructor and a physical education instructor that will also serve as the lead soccer coach. The English instructor will work exclusively in the classroom ,while the physical education instructor will work in the classroom, but he/she will also be responsible for the soccer team at practices and as they travel to games. There are four people applying for each position The university will be using several methods in their selection process. Read the case below and answer the questions that follow. 1. The school assembles an Interview panel, and each panelist is free to ask any questions as long as they are legally permissible. $\square $ v 2. All applicants provide friends and family members in their list of references. $\square $ v 3. The university implements new selection tool for Its admissions department and is using it as part of the selection process for applicants $\square $ v 4. All of the PE position applicants are asked to perform the same physical ability test. $\square $ v 5. All of the applicants will be toking a personality inventory (test). $\square $ v 6. The four applicants for the PE department position are asked to take a drug test. $\square $ v 7. For the PE position, a physical ability test will be part of the selection process where each person chooses and demonstrates activities in which he/she excels. $\square $ v

Reading Excerpt 1: The Constitution - Article I,Section 2 The House of Representatives shall be composed of Members chosen every second Year by the People of the several States, and the Electors in each State shall have the Qualifications requisite for Electors of the most numerous Branch of the State Legislature.No Person shall be a Representative who shall not have attained to the Age of twenty five Years, and been seven Years a Citizen of the United States, and who shall not, when elected, be an Inhabitant of that State in which he shall be chosen. Structure and Qualifications of the House: According to Article I,Section 2, what are the key qualifications and structure of the House of Representatives? Answer: __ Reading Excerpt 2: The Constitution - Article I Section 3 The Senate of the United States shall be composed of two Senators from each State, chosen by the Legislature thereof; (Th preceding words in parentheses were superseded by the 17th Amendment,section 1.) for six Years,and each Senator shal one Vote. No Person shall be a Senator who shall not have attained to the Age of thirty Years, and been nine Years a Citizen of the States, and who shall not, when elected, be an Inhabitant of that State for which he shall be chosen. tructure and Qualifications of the Senate: cording to Article I,Section 3, what are the key qualifications and structure of the Senate? swer: __

The chart below lists the constitutional requirements for serving as a member of the Florida House of Representatives. . Be 21 Years Old ? - Live in the district of Florida represented Which constitutional requirement completes the chart? Have been a resident of Florida for two years Have previcusly served in local government Bea natural born citizen Havelived in the United States for 14 years

Controls through legislative actions and their judicial interpretation on conflict of interest discrimination, nepotism and private use of public resources are classified in which of the following 2. Professional norms b. Public opinion c. Virtue d. Laws

Which of the following is NOT a basis prohibited by Federal civil rights laws? Behavior Race Disability Sex

Which of the following is not an approved record destruction method? Data Deletion Data Archival Data Transfer

7. Professional providers must provide? a. Names of hospitals where physicians have admitting privileges b. Years a physician has been practicing c. Accreditation status d. All of the above

If someone is convicted of a crime during a criminal trial, should they also be subjected to a civil suit regarding the same matter? Would this fall under the double jeopardy clause?Explain your answer in detail. "You must respond to 2 students posts o receive full credit. You must start a thread before you can read and reply to other threads