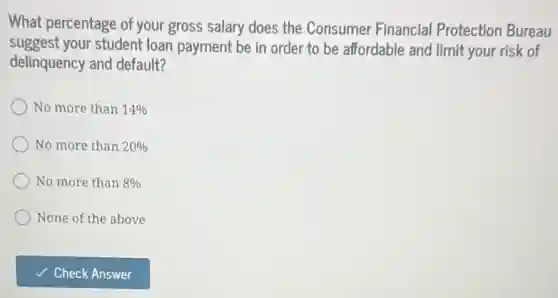

What percentage of your gross salary does the Consumer Financia Protection Bureau suggest your student loan payment be in order to be affordable and limit your risk of delinquency and default? No more than 14% No more than 20% No more than 8% None of the above

Solution4.0(342 votes)

Answer

Explanation

Similar Questions

Using your knowledge of the general environment and the task environment, choose the best answers to the questions posed. A manager who is considering entry to a new market must carefully consider all aspects of the environment as it relates to that market,including any obstacles posed by __ who already have established relationships with suppliers and customers.

Discussion Question $4-18(L0.4)$ Carlos is retired and receives Social Security benefits During the year; Carlos appeared on a television game show and won $\$ 5,000$ What is the largest amount by which Carlos gross income can increase as a result of the prize? Other income is $\square $ in the computation of modified adjusted gross income (used to determine taxable Social Security benefits). Therefore, any increase in other income $\square $ the Social Security benefits to be taxable potentially $\square $ taxable income.

In the following diagram,identify the different types of corporate cultures. Sources: Based on D.R. Dension and A K. Mishra. (March-April 1995). Toward a Theory of Organizational Culture and Effectiveness. Organization Science, $6(2)$ $204-223$ Hooijberg, R, Retrock,F. (1993). On Cultural Change: Using the Competing Values Framework to Help Leaders Execute a Transformational Strategy. Human Resource Management, $32(1),29-50$ Quinn, R. E. (1988). Beyond Rational Management: Mastering the Paradoxes and Competing Demands of High Performance, San Francisco: Jossey Bass.

STATION 2:CASH VALUE CHANGE IN CA COMMODITIES 1. Which commodity in the Top 20 has had the highest decrease in cash receipts from 2020 to 2022 Why do you think it has decreased?

Indicate whether the following statements are "True" or "False" regarding income from partnerships, S corporations trusts, and estates. $\square $ $\square $ a A partnership is a separate taxable entity. a A small business corporation may elect to be taxed similarly to a partnership. c. Each partner reports his or her distributive share of the partnership's income and deductions for the partnership's tax year ending in or with the partner's tax year. d. The beneficaries of estates and trusts generally are taxed on the income eamed by the estates or trusts that is actually distributed or required to be distributed to them. $\square $ $\square $

A company manufactures tables The factory is open 14 hours each day There are 18 steps that go into making tables. The company needs to manufacture 600 tables each day. What is the required cycle time (in sec/unit)for this company? (Choose the closest answer) 96 112 101 132 152 84

What hazard is present on this worksite? Select the best option. Fall hazard Electrocution hazard Caught-in or-between hazard Biological hazard If you need to review this content, it can be found in the Gurdrails

Fill in the Blank Question A standard mortgage clause which, in the case of default on a payment, allows the lender to declare the entire loan due and payable is an $\square $ clause. Need help? Review these concept resources. (13 Read About the Concept

Selected transactions for Verdent Lawn Care Company are as follows. Describe the effect of each transaction on assets liabilities, and stockholders equity. For example, the first answer is: Increase in assets and increase in stockholders' equity. 1. Sold common stock for cash to start business. $\square $ 2.Paid monthly rent. $\square $ 3. Purchased equipment on account. $\square $ 4. Billed customers for services performed. $\square $ 5. Paid dividends. $\square $ 6. Received cash from customers billed in (4). $\square $ 7. Incurred advertising expense on account. $\square $ 8. Purchased additional equipment for cash. $\square $ 9. Received cash from customers when service was performed. $\square $

Open in E-Book e very much nostly to other ample, additional farmer could ere different y sell a bout some ents for Milk Cotton ("The ifferentiated so ples are the Hey there! I'm ACE . I'm here to help you explore The Economics of Advertising . I'll guide you through key concepts, check your understanding, and keep you engaged by leading you through structured learning waypoints based on your course content. You can view your current waypoint and track upcoming ones by clicking the Progress Ring which will automatically update with your progress. Let's get started by thinking about why some firms choose to advertise and others don't. According to the textbook, what kind of products are firms most willing to spend money advertising?Why do you think that is?