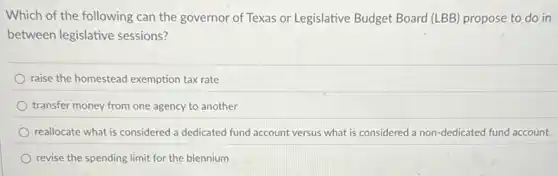

Which of the following can the governor of Texas or Legislative Budget Board (LBB) propose to do in between legislative sessions? raise the homestead exemption tax rate transfer money from one agency to another reallocate what is considered a dedicated fund account versus what is considered a non-dedicated fund account. revise the spending limit for the biennium

Solution4.1(267 votes)

Answer

Explanation

Similar Questions

Which of the following makes a false promise wrong, according to Kant It goes against the Bible's command It leads to bad results when people don't keep their promises It treats the person who believes the false promise as a thing and not as a person It would end up harming the promisor him or herself in the long run

Which of the following would be treating someone as a means, according to Kant Asking the person to lend me some money and they do it Forcing the person to lend me some money Deceiving the person into lending me some money All of the above

The election for president of the United States ALWAYS takes place in what month? November January December

What is a defining characteristic of Independents? They belong to the largest political party They always vote Democratic They do not officially belong to a political party They support strong federal control

Which of the following is not a place where you can register to vote in Virginia? DMV Registrar Office Church Schools or Government Offices

In Virginia, which of these is a way to vote absentee? Voting online only Voting in person on election day only Voting by mail or in person before election day Voting by phone

5. What country is the United States Space Program competing with? a. Canada b. South Africa c. China d. Russia

What is the effect of the causes shown? Cause: Lack of interest Cause: Failure to register Cause: Belief that your vote doesn't matter Cause: No time or too busy Citizens fail to show up for jury duty Employees demonstrate poor work ethic Citizens register to vote in Virginia Citizens fail to vote

Where can you find important voting dates and information for elections in Virginia? The US Department of Elections website The Virginia Department of Elections website Local library Court House

In chapter 5, in the section entitled "The Hedonistic Calculus," Bentham's development of the hedonistic calculus is discussed. Bentham was a product of the "Enlightenment Period" also known as the "Age of Reason." Which of the following is the best answer with respect to what the text says is an effect of the influence of the "Enlightenment Period" or the "Age of Reason" on Bentham's development of Utilitarianism and in particular the hedonistic calculus? That is which of the following is true of the hedonistic calculus? proper moral conduct is discovered through reason alone proper moral conduct is calculated mathematically proper moral conduct is determined solely through the use of logic proper moral conduct can be determined scientifically, through experimentation and trial and error